Before we get into blockchain, we are going to take a short detour to understand what is the Byzantine General's Problem.

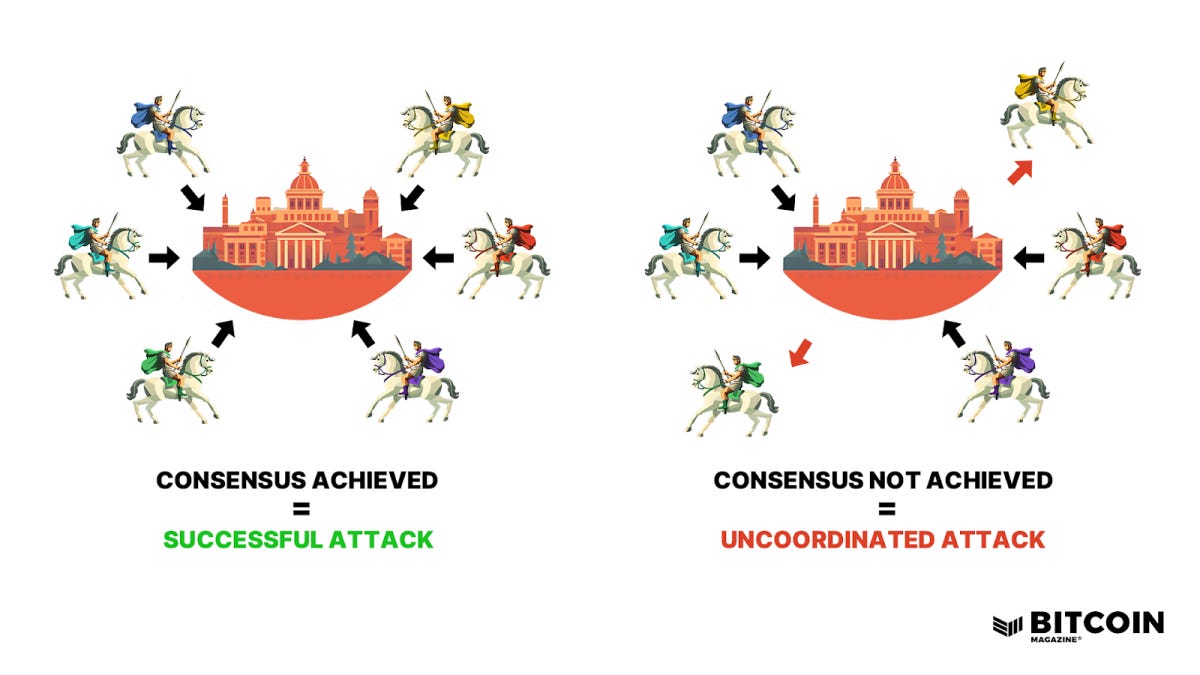

It is a classic game theory problem based on an imaginary Byzantine army situation. The Byzantine army is divided into many battalions, each led by a general. Their objective is to attack & capture a fortress. Each general leads his battalion from different sides of this fortress. The generals need to agree on one unified strategy, whether to move forward, or to retreat. These generals can communicate via messengers going back & forth, to agree to a concerted plan of action. This way, all battalions coordinate and attack from all sides in a concerted fashion.

Image: https://bitcoinmagazine.com/

So whats the problem, you say? What if some of the generals vote in favour of attacking, and some vote in favour of retreating? They need a consensus. It is possible that there are enemy agents within the army who manipulate the message. If there was an authority figure, say a 'commanding general' who commands all other generals to attack simultaneously, one rogue general may retreat nevertheless. Further, what if the 'commanding general' himself was corrupt?

So the problem really is, how do the generals verify the truth in a transparent way without there being one 'central' commanding authority of any kind validating the truthfulness of the messages?

Now lets translate the Byzantine General's Problem to the world of money. Along comes Satoshi Nakamoto, the brain behind blockchain who wrote this white paper on the topic in 2008.

"The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.

- Satoshi Nakamoto"

Bitcoin was the first solution to the Byzantine General's Problem with respect to money. The 'verified consensus' to which all the generals need to agree to, is blockchain.

Blockchain is a public, distributed record of all transactions done by all users in a network. The record isn’t held by any one central authority, but is ‘distributed’ on a network. Each block in the blockchain contains not only the data about that transaction but also a timestamp marking when it occurred. Cryptography is used to ensure that the information cannot be tampered with. If all users of the blockchain network, referred to as 'nodes', agree to a transaction (that it occurred and in what sequence it occurred in), this verifies the ownership of that money. No central authority needed. All generals of the Byzantine army know exactly what the message is.

Now remember, the network would have to be non-corrupt & manipulation-free. How does blockchain really achieve this? This brings us to the concept of 'Proof of Work'.

‘Proof of work’ is a blockchain consensus mechanism. It is provided by specialised workers called 'coin miners'. The purpose of ‘Proof of work’ is to deter manipulation of data. It is a mechanism to prevent users from spending the same coins in two different places. While a physical dollar bill once handed over to a shopkeeper is considered 'spent', a bitcoin is just a computer file. One could duplicate a computer file & spend it over & over again. The 'Proof of work' mechanism solves this double-spend problem by incentivizing coin miners to verify the integrity of each transaction before adding it to the blockchain.

So what exactly do the coin miners need to do? They need to solve a complex equation, like a mathematical puzzle. This process of solving the mathematical puzzle is called mining. The coin miner who is the first to solve the puzzle, gets to add the newest batch of data i.e. transactions to the blockchain. The others, then verify what he has added. A coin miner is rewarded with a specific amount of cryptocurrency for doing so. The “work” involved in proof of work needs to be significant, i.e. the system requires coin miners to compete with each other to be the first to solve this puzzle. The winning coin miner only receives his reward AFTER others verify that the block of data added by him to the chain is valid. Since miners would’ve invested significant resources in computer infrastructure & energy to get to this point, they’re motivated to be honest when adding a block.

The set of rules governing who can mine a coin, which transactions are valid and which are invalid, and how to verify, are clear & objective. Once a block has been added to the blockchain, it cannot be removed, making past blocks immutable.

The result is a de-centralised system where users hold the crypto keys to their own money, they transact directly with each other, and a network checks for double-spending.

»Read further: Part 2 of this explainer