Last week, we read this headline saying Brex is mulling an IPO at a valuation of $500 million. This came shortly after Brex announced that its customer acquisition accelerated by 50% and enterprise business grew by 91% in 2024.

Founded by two young Brazilian co-founders in the Silicon Valley in 2017, Brex started off with a simple value proposition - providing a corporate credit card for Silicon Valley entrepreneurs. This was a time when traditional banks did not easily issue cards to small entrepreneurs without some form of personal guarantee. It was a niggling pain point for entrepreneurs. Brex decided to issue corporate cards based on projected cash flows of the entrepreneurial venture, rather than looking at it as a credit risk on the entrepreneur himself.

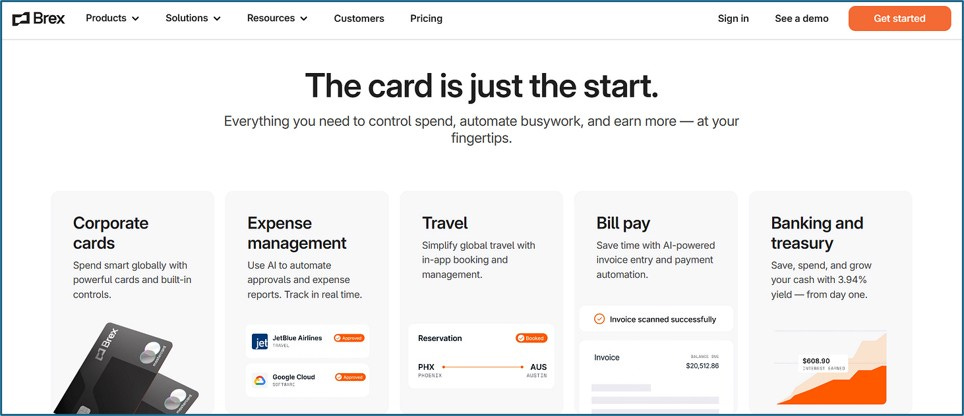

From there on, Brex’s value proposition made a few jumps - from corporate credit cards to a full spend management platform, Brex has partnered with many Silicon Valley entrepreneurs on their journey.

The spend management fintech world is a crowded space. In Australia, ProSpend seems to be going strong. Swedish fintech Mynt is expanding in Europe. Danish fintech Cardly has partnered with Visa for spend management services to Visa issuers. U.S. is home to Spendesk & Airbase already. Y-Combinator has backed Kodo in India. Spenmo made a name for itself in Singapore before it ran into troubles from an employee embezzlement scandal.

All these fintechs are looking at the same market — the small & medium enterprises that are under-served by the banks & the large ERP providers. A cloud-based platform where small & medium entrepreneurs can pay by usage or by subscription, without having to make large upfront capital spends. Employees can access these tools and make expense claims, or flight bookings, from anywhere, even from their smart phones; and management can see smart dashboards to approve & track what their employees are spending on vs. what is budgeted.

Is the market over-crowded? It most certainly is. I don’t think there’s going to be one winner in this space though. Winners will be the ones who find niches for themselves. Brex has done a good job championing the Silicon Valley entrepreneurs; not just providing spend management dashboards, but a whole ecosystem of entrepreneurial needs (including guidance on fund raising). Rippling, started off as a HR platform, and seamlessly weaves in employee credit cards into its employee onboarding process. Coupa started off as a procurement platform that now identifies as a spend management platform. The platforms can approach the user journeys in multiple ways, and who’s to say which customisations will click the most with such a global, diverse user set! There definitely will be room for many. Localisation (as per local tax rules, accounting standards, payment platforms & vendors) is also an important factor. As with all embedded solutions, a good starting point is the question, ‘how do I add the most value to the user’s journey?’